Are you in need of quick cash to cover unexpected expenses or emergencies? Look no further than Zaplo! This modern online loan provider offers fast and easy loans with minimal hassle. Gone are the days of waiting weeks for loan approval or dealing with piles of paperwork. With Zaplo, you can get the money you need when you need it most. Keep reading to learn more about how this innovative lending service works and how you can take advantage of its benefits.

What is Zaplo?

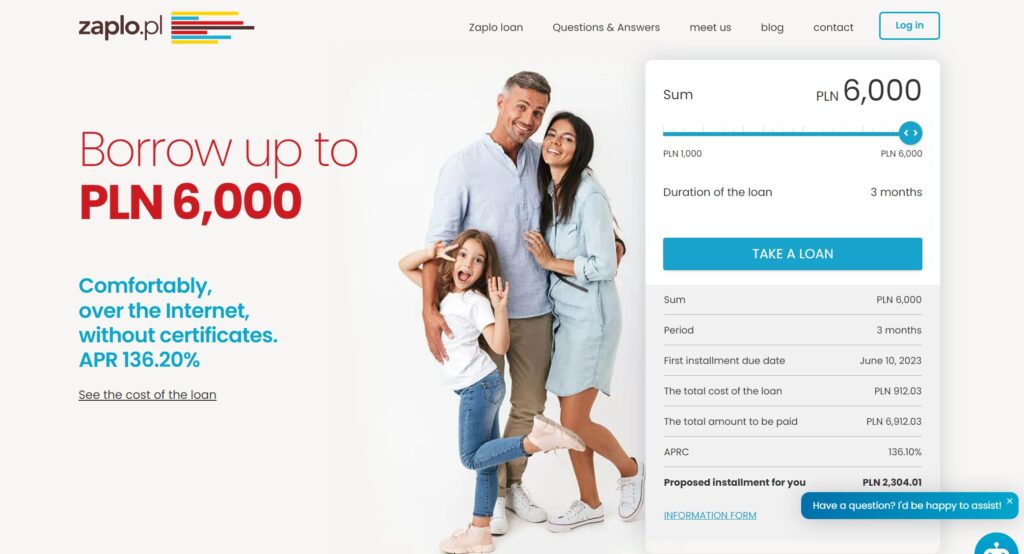

Zaplo is a modern online loan provider that offers quick and easy loans to individuals in need of fast cash. Unlike traditional banks or lending institutions, Zaplo operates entirely online, making the application process simple and convenient.

Zaplo’s mission is to provide reliable financial solutions for those who need it most. Whether you’re facing unexpected expenses or emergencies, Zaplo can help get you back on track with its fast and hassle-free loan process.

One of the benefits of using Zaplo is its commitment to transparency. The company provides clear information about fees, payment schedules, and other important details upfront so borrowers can make informed decisions.

Zaplo offers a fresh approach to personal loans with its customer-focused approach and innovative technology. If you’re in need of quick cash without the headaches typically associated with borrowing from traditional lenders, consider giving Zaplo a try!

How Zaplo Works

Zaplo is an online lending platform that offers fast and easy loans to people in need of quick cash. But how does it work? It all starts with the application process.

To apply for a loan with Zaplo, simply visit their website and fill out the online application form. You’ll need to provide basic personal information, as well as details about your income and employment status.

Once you’ve submitted your application, Zaplo will review it and make a decision on whether or not to grant you a loan. This process typically takes just a few minutes, so you can get an answer quickly.

If approved for a loan, you’ll be given specific terms including the amount borrowed, interest rate, repayment schedule and any fees associated with the loan. After accepting these terms, funds will be deposited directly into your bank account within 24 hours.

Repaying your loan is also simple with Zaplo’s automatic payment system. Payments are automatically deducted from your account on predetermined dates until the full balance is paid off.

Zaplo works by streamlining the lending process through its easy-to-use platform while providing customers access to quick cash when they need it most.

How to Apply for a Loan with Zaplo

Applying for a loan with Zaplo is quick and easy. The first step is to visit their website and fill out the application form. You will need to provide personal information such as your name, address, phone number, and email address.

Next, you will be asked to provide employment information including your employer’s name and contact information, how long you have been employed there, and your income.

After submitting your application, it will be reviewed by Zaplo’s team of underwriters who will assess whether you meet their lending criteria. If approved, funds can typically be deposited in your account within 24 hours.

It’s important to note that while Zaplo offers loans with flexible repayment terms ranging from 3 months up to 36 months depending on the amount borrowed; interest rates are higher than those offered by traditional lenders due to the convenience they offer.

Applying for a loan with Zaplo is straightforward meaning even if this is new territory for you just follow these steps above or reach out directly via chat or telephone support lines available on their site anytime!

Loan under control Permanent access to the Customer Profile.

At Zaplo, we believe in transparency and giving our customers full control over their loans. That’s why we offer permanent access to the Customer Profile.

With access to your profile, you can track your loan payments and view your payment history at any time. This means there are no surprises when it comes to repayments and you can stay on top of your finances.

Additionally, if you need to make changes or updates to your personal information or repayment plan, all of this can be done easily through the customer profile.

We understand that life is unpredictable and circumstances may change unexpectedly. With permanent access to your profile, we aim to give you peace of mind knowing that you always have control over your loan.

Our goal is not only to provide fast cash solutions but also responsible lending practices that put our customers first. And with permanent access to the Customer Profile, we believe we’re achieving just that.

A modern loan completely online ! Take a loan.

Gone are the days when you have to visit physical banks and fill out long application forms to get a loan. With Zaplo’s modern loan, everything can be done online!

With just a few clicks, you can apply for a loan from the comfort of your own home or anywhere with an internet connection. This makes it easier for those who have busy schedules and cannot afford to go to banks during business hours.

Zaplo’s online platform is user-friendly, making it easy even for first-time borrowers to navigate through the process. The website provides all necessary information about their loans such as interest rates, payment terms, and fees so that customers can make informed decisions before taking out any loans.

Another great feature of Zaplo’s modern loan is its accessibility. You don’t need collateral or a guarantor to apply for this type of loan, which means anyone can take advantage of this service regardless of their financial situation.

Zaplo ensures that customer data is protected at all times by implementing strict security measures on their website. They use encryption technology and follow industry standards to keep personal information safe.

Getting a loan has never been more convenient than with Zaplo’s modern online system.

Conclusion.

Zaplo offers a quick and easy way to get cash fast. Their online loan application process is simple and straightforward, making it accessible for anyone who needs a loan. With the ability to access your customer profile permanently, you are always in control of your loans with Zaplo.

Their modern approach to lending makes them stand out from traditional lenders. Plus, their commitment to transparency ensures that you know exactly what you’re getting into when applying for a loan.

If you need cash fast, consider taking out a loan with Zaplo. With their user-friendly platform and excellent customer service team ready to assist at any time, they make borrowing money hassle-free so that you can focus on what really matters: getting back on track financially!